Americans love taking vacations. This year, more than 35% of all Americans are expected to take a local or international vacation.

During vacations, we take our time off from our daily duties. We forget about work and indulge in pleasure. We see places we’ve never seen, and we meet new people from different countries and cultures. During vacations, we bond as a family and share kindness with strangers.

As we enjoy the vacation, we want our mind to be at ease. We want to think about the moment, not the past or the office. We don’t want to think about money during vacation.

You don’t need to be very rich to have such a peaceful and joyous vacation. Regardless of your salary, you can afford a real vacation if you are well prepared.

How do you achieve this?

Set up a Vacation Fund

To enjoy your vacation, you need to set up a vacation fund which in simple terms, is a bank account dedicated to this vacation. From your paycheck or savings, set aside little money to go towards your vacation. To make it easy, you can automate the deposits using your bank’s automatic deposits.

Alternatively, you can use a company called Acorns. Acorns connects your debit and credit card and round-ups all transactions that you make and invests the difference. For example, if you buy an item for $6, Acorns will take the $4 and invest it. It also accepts deposits of other amounts.

Provided you have started saving early, by the time your vacation date comes, you will have enough money to spend.

Quick Note

I advise people to budget their trip using the amount in this account. Also, I recommend that you start making your savings early and if you are married, you can combine the savings with your spouse.

Cancel Unnecessary Subscriptions

These days, there are subscriptions for everything. While some of the subscriptions are good, some of them are not necessary.

For example, BirchBox is a subscription service that sends you a box with samples of beauty products for $10 a month. While the service is good, is it really necessary?

Another example of a good subscription service that you can cancel is Purple Carrot. For $68 a week, the company delivers to you a box of plant-based ingredients and a recipe. It’s a good service, but one that you can do without.

Another example is a magazine subscription. Economist charges $87 for a three-month subscription. But, by subscribing to a service like Magzter, you get The Economist and thousands of magazines for as little as $10 per month.

Just have a look at all of your subscriptions and see the ones you don’t need and cancel them.

Don’t Take Gifts in Your Wedding

This method is especially for couples who are thinking of having a honeymoon after their wedding. During weddings, friends and family members are known to bring a lot of gifts, but often, they buy things that you don’t need.

To prevent this, you can use services like TravelersJoy and HoneyFund to raise money for your vacation.

In the wedding invitation card, you can have a link to one of your fund’s account where your friends will offer their donations.

In Honey Fund, more than $500 million has already been raised for a honeymoon. You can do it too.

Don’t opt for Peak Months

The rule of the thumb is if you want to make more savings travel during months that are not peak. During the low season, hotels and flights usually lower their price because of low demand. During that time, most beaches are usually empty.

For example, a vacation house that goes for $7,500 during peak season at Outer Banks, can go for as little as $2,000 during the off-peak seasons.

Travelling at this time will give you the flexibility to visit many places at half the cost you would spend during the peak season.

Book Economy

Instead of booking a first class or business class ticket, I recommend that you select the economy package.

I will illustrate it with an example. If you are traveling from New York to Nairobi using an Emirates plane, you will pay $943 in the Economy, $7,881 in Business Class, and $17,726 in the First Class.

Granted, the latter classes are more comfortable and offer more amenities than the Economy but, consider the amount of money you will save.

You can use the money you save to do other interesting things, including extending your trip.

Give Away Your House and Car

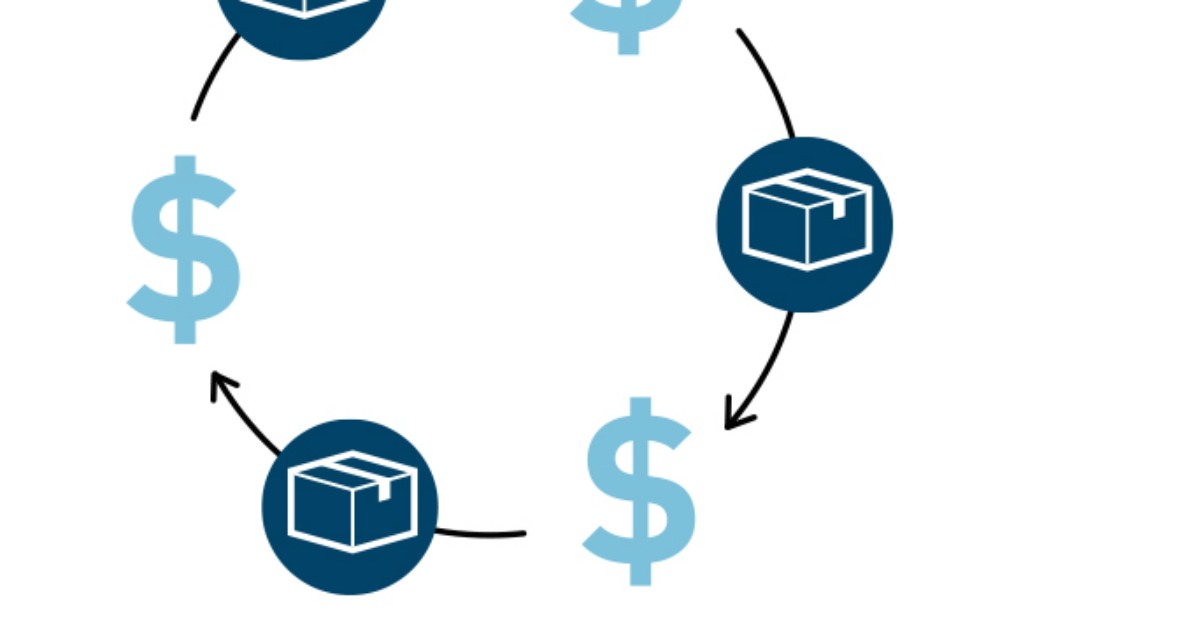

If you are traveling as a family, it means that your house and cars will be underutilized. But, there is a better way to do this.

For your house, you can rent it out to a stranger using services like Airbnb and HomeAway while for your car, you can rent it out using companies like Zipcar.

Using these services, you will be able to make money from your idle assets as you enjoy your holiday. Further, using their dashboard, you can monitor the amount of money you make and even transfer it to your travel account.

Supplement Your Income

After making your decision on the vacation, you can start saving by doing simple jobs that supplement your income. This could involve tasks like driving for Uber or renting your spare room using Airbnb.

It can also involve doing simple tasks like using Inbox Dollars or Transcribing using TranscribeMe or doing simple tasks in Upwork.

Since you have a full-time job, the amount of money you make using these platforms won’t be a lot. But, it will go a long way in supplementing your traveling expenses.

For example, if you can make about $500 per week, in one year, that will be $26,000 which is good money for a trip.

Quit the Gym and Yoga

Being fit is very important for your health. But, quitting the gym and the yoga studio workouts can save you a lot of money.

For example, in Los Angeles, YogaWorks charges up to $325 per month for Equinox charges up to $290 per month for gym services.

For your vacation, you can do away with these services and start doing your own routines. Mashable lists several websites that give you free access to training and Yoga videos. There are other apps like 30 Day Fitness Challenge, and Home Workouts give you access to free instructions that you can do at home.

So, if you cancel your YogaWorks subscription for a year, you can save about $4,000 which can go towards your vacation.

Sell Your Unnecessary Stuff

You see the old shoes you no longer wear? Or the old television set in your garage? Or the old car you no longer use? Or the spoilt air conditioner you replaced the other day?

All these things might seem unnecessary to you but useful to other people. You can sell everything you don’t need on Craigslist, Letgo, and even eBay for good money.

Just Do What You Love

Another way you can raise money is simply doing what you love. If you are an artist, paint. If you are good at pottery, do it and if you are good at sculpting, do it in your free time.

After doing what you love doing, you can sell your creations at Etsy, Amazon, and even Artfire. These platforms provide you with a place where you can list your handmade products and attract customers.

Final Thoughts

Vacations are not reserved for people who have a lot of money. With a little planning and some savings, no matter the amount of money you make every year, you too can enjoy the gift of vacation.

The strategy is to start planning early, being disciplined, and saving as much money as possible to enjoy during your vacation.